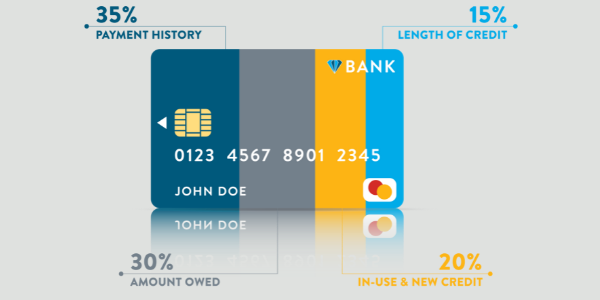

You know credit scores are important, but you may be wondering how they are calculated and what the big deal is. This all-important number can be looked at for a multitude of reasons: when you get a job, lease an apartment, open a new account, or apply for a loan---including a home loan.

Our Blog Puts YOU in the Driver’s Seat

Helping customers like you achieve their financial goals is all we do, which is why we’re arming you with our expert insight, tips, and advice to help you get there.

How Your Credit Score Is Calculated

What Is a Good Credit Score to Get a Mortgage Loan?

Before you go shopping for a new home, you'll want to ensure that you meet the credit score requirements to secure a mortgage loan. And while many factors go into qualifying, a good credit score is definitely one of them.

We know that getting "rated" can make you feel like you're back in school. Like in school, however, with a bit of hard work, discipline, and dedication, you can improve your credit scores quickly!

So let's jump right in, starting with the obvious.

Can I Buy a Home with No Credit History?

It's true that credit is an important part of qualifying for a home loan, but it's not the end-all and be-all. Buying a home with no credit is possible---the process just takes a few extra steps. Those steps can depend on a few factors, including whether you have a cosigner, as well as the size of your down payment. They will also depend on what type of home loan you're pursuing.

Mortgage Review: Take Advantage of Improving Interest Rates

Mortgage rates have been a roller-coaster ride this year, leaving many homeowners wondering whether now is the right time to buy a home, refinance their existing mortgage, or simply stay put.

A quick mortgage review can help you uncover ways to save money, access cash, or position yourself for future financial goals, especially if you bought or refinanced in the past few years. Whether rates move up or down next, knowing where you stand puts you in control.

Budgeting for Homeownership in the New Year

There’s no better time than now to start preparing for homeownership. If your financial goals include things like saving for retirement, paying off student loan debt, or buying a home, this article provides some solid financial planning advice that will get you headed in the right direction.

As an additional resource, you can also download our personal budgeting guide here. When you have a solid plan and set a budget for homeownership, you may find that you’re able to buy a home more quickly than expected.

How to Set Achievable Financial Goals

New year, new goals, right? When it comes to personal finances and goal-setting, creating financial goals can be one of the most meaningful things you can do for yourself and your family.

The Biggest VA Home Loan Myths—BUSTED!

VA Home Loan Myths

The VA home loan program is an amazing benefit for our deserving active-duty service members, veterans, and surviving spouses of veterans. While no one could ever repay you for the sacrifices you’ve made, the VA home loan can make your dreams of homeownership just a little easier to achieve.

What You Need to Know About Qualifying for VA High Balance Loans

Qualifying for VA High Balance Loans

Obtaining a jumbo VA loan or a VA high balance loan, a type of government-backed home loan, provides several significant benefits for eligible veterans and their surviving spouses. While there isn’t technically a jumbo VA loan (all VA loans are treated similarly, regardless of loan amount), it’s common to think of the larger loans as “jumbo” or "high balance" for the sake of discussion.

What Is a Non-QM Mortgage and Who Qualifies?

For many homebuyers, the path to homeownership follows a traditional route: W-2 income, strong credit, and a standard debt-to-income ratio. But today’s borrowers don’t always fit that mold. Entrepreneurs, investors, self-employed professionals, and those with unique financial situations often need alternative solutions. That’s where non-QM (non-qualified mortgage) home loans come in.

APM Financial Fitness: September 2025

Last month, many countries began to feel the impact of tariffs introduced earlier this year, leaving many of us waiting to see if the pricing on certain products would change. As of this time, tariffs ran from 10% for the United Kingdom to 50% for Brazil. However, these are subject to change, including the tariffs between China/United States. A recent truce between the countries means the U.S. will keep its standard tariff rate on Chinese goods at 30% while China maintains a 10% rate on American goods.

Second Home vs. Investment Property: What’s the Difference?

You own your primary residence, but you’re thinking about buying a second home or possibly an investment property. Congrats! Being in a financial position to make that kind of real estate investment is a major accomplishment, and you should be proud of that.

8 Tips for Buying an Investment Property

Buying an investment property can be one of the keys to financial freedom and long-term wealth. Whether you want to enjoy rental income, tax benefits, or both, owning rental properties can help you achieve your goals quickly.

Is a Reverse Mortgage Right for You?

Retirement should be your time to relax and enjoy life. But if you’re like many American seniors today, you might be feeling the pinch of rising costs. Healthcare expenses that seem to climb every year and inflation eating into your fixed income can be a lot to manage.

How to Purchase a Home Using a Reverse Mortgage Loan

What if you could buy your dream retirement home without monthly mortgage payments?

If you’re 62 or older and thinking about making a move, traditional mortgage loans might feel overwhelming. The thought of taking on new monthly payments in retirement can be stressful, especially when you’re living on a fixed income.

5 Tax Changes for Homeowners in 2025 That Could Save You Money

Owning a home has always come with benefits—both emotional and financial. But the 2025 tax changes for homeowners are giving buyers, longtime homeowners, and investors more reasons to celebrate.

How to Bridge to Buy: Your Guide to Buying Before Selling

Buying a new home while still owning your current one can feel overwhelming—but it doesn’t have to be. Whether you’re relocating, upgrading, or simply found your dream home sooner than expected, there are strategic ways to make it happen without having to sell first.

Seller PreLock Program: The Secret to Selling Faster Today

Your home is more than a property. It’s where birthday candles were blown out and holiday memories were made. When it’s time to sell, you want the full value of your home.

Bridge Loans: Buy Before You Sell Your Existing Home

Are you dreaming of moving into a new home or condo that better fits your lifestyle but don’t know how you can confidently buy a new home while selling the one you’re in?

TOP POSTS

Subscribe to our BlogSign up to stay up to date with the latest news, insights and more from American Pacific Mortgage!

RECENT POSTS