Your credit score plays a large role in getting the home loan with the most favorable terms. Knowing your score and reviewing your credit report regularly may help prevent unexpected surprises.

You can get a free copy of your report annually from all three of the major credit reporting agencies by visiting Annual Credit Report and requesting it. Once you receive it, review each item thoroughly, check for mistakes, and address any errors immediately. Be sure to contact both the credit bureau and the creditor that reported the mistake to have it fixed.

Credit scores are calculated by taking into consideration payment history, amounts owed, length of credit, and in-use/new credit.

Infographic showing how FICO scores are calculated which range from low to high. The lowest credit score is 300, the highest credit score is 850. The credit card represents the percentage with which various factors contribute to the overall FICO score. Starting from the top left of the credit card, (1) 35% of the scoring is based on payment history, (2) 15% is based on length of credit, (3) 30% is based on the amount owed on credit, and (4) 20% is based on in-use and new credit.

Now that you know your score and what factors are included, it’s important to understand what the score means. Typically, a score over 740 is considered excellent, while a score under 660 is considered at least somewhat challenged. We have loan programs for nearly every category of score, so don’t despair. By working with a loan advisor, you can work on raising your score with some changes to how you’re spending your money—or take a look at the programs that are available to you now.

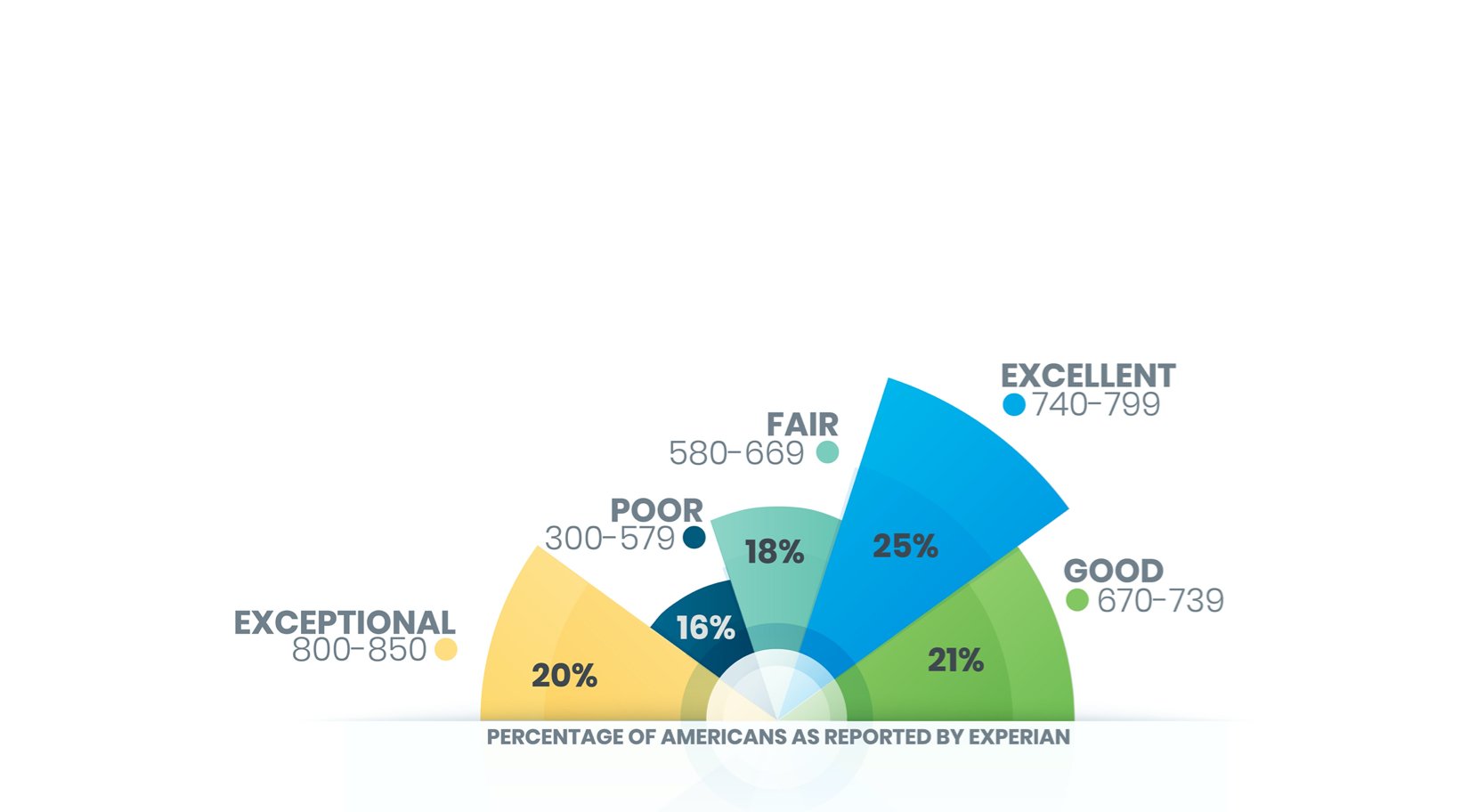

Pie chart Infographic detailing the percentage of Americans which are rated in various credit scoring tiers as reported by Experian. The tiers reported in the pie chart from left to right are as follows: (1) 20% have exceptional credit with an 800-850 score, (2) 16% have poor credit with an 300-579 score, (3) 18% have fair credit with an 580-669 score, (4) 25% have excellent credit with an 740-799 score, and (5) 21% have good credit with an 670-739 score.

We understand that sometimes you need to do things at your own pace. Our resources, tools, and advice are here for you any time.