There are so many options out there that promise to help you build wealth. High-interest rate savings accounts can make a few drops in the bucket, but not many. The stock market is certainly a vehicle for making money, but you have to know what you’re doing, what you’re buying, and when to get out. Retirement accounts can be a great way to accrue money over time, but 65 is a long way off for some people. Then there are cryptocurrencies. A year ago, it seemed the sky was the limit for these virtual coins. This year, it’s a whole different story.

Our Blog Puts YOU in the Driver’s Seat

Helping customers like you achieve their financial goals is all we do, which is why we’re arming you with our expert insight, tips, and advice to help you get there.

Real Estate Investing to Build Long-Term Wealth

10 Ways to Win a Bidding War on a House

In today’s competitive housing market, there’s a good chance that your offer won’t be the only one a seller is entertaining. It’s not uncommon to hear sellers have more than 10 offers for one property . . . or that some buyers have put in offers on more than 20 homes, just to lose out time and time again.

In a market like this, it’s not enough to simply have your ducks in a row and walk in with a pre-approval. A market like this takes work if you want to win a bidding war.

What You Need to Know about Sales Price vs. Appraised Value

Like any other item for sale, the value of a home can be viewed two ways: the price you pay for a home, which can be the list price—or a higher or lower price depending on demand (in a hot market, the price may be above the asking price, while in a cooler market it might be below), and there’s the home’s appraised value. This is the price determined by a licensed professional home appraiser who will take many factors into consideration, including the home’s features, condition, improvements, location, and market trends.

Get Your Offer Accepted with APM’s Keys on Time™ Program

It’s a competitive market out there, but did you know there are things you can do to increase the chances your offer will be accepted? We’re not talking about the standard strategies like improving your credit, paying off debt, applying for pre-approval.

We’re talking about programs like APM’s Keys on Time™ (KOT).

What You Need to Know About Getting a Mortgage When Self-Employed

Being self-employed can be amazing! To many it sounds wonderful—you get to be your own boss, set your own hours, and work from anywhere! As many who are self-employed know, it’s not as simple as that (long days, making payroll, and no steady paycheck). There are many perks to entrepreneurship, including that invigorating feeling of creating a business, but some people worry that this path will make it difficult to qualify for big-ticket purchases like a home.

Here’s How Your Job Affects Your Mortgage

You may be aware that the mortgage application process differs slightly depending on your type of employment. It’s not that mortgage companies favor a W-2 employee over the self-employed or a full-time employee over someone whose job is commission-based. It simply boils down to differences in verifying employment, income, and job stability.

Pre-Approval vs. Pre-Qualification: What’s the Difference?

Deciding it’s time to buy a home can be exhilarating—but it’s also a little daunting. Taking time to research your options before you begin your home search is often the best place to start. One big factor to consider is whether you need a pre-approval vs. a pre-qualification.

How Making Extra Mortgage Payments Can Benefit You

Owning your home provides safety, security, and stability when it comes to your living situation, especially if you have a fixed-rate mortgage. Knowing that your mortgage payment will never increase and a landlord will never ask you to move can do wonders for your psyche—and your sleep!

You know the one thing that can provide even more safety, security, and stability? Paying off your home loan early. The best part is you don’t have to write a massive six-figure check to do this. Making as little as one extra mortgage payment a year can yield big-time results, and savings, as you work towards paying down your principal.

Making extra mortgage payments can be done in a few ways.

Planning to Buy a House in the New Year

The New Year is full of new goals. For many, planning to buy a house is one of them—and who could blame them? With interest rates teetering at historic lows, the door for many borrowers has been opened, and these rates have provided some borrowers the opportunity to increase their price range.

If you’re ready to get the process started to ensure you’ve got all your ducks in a row when it comes time to pull the trigger and submit an offer on a house, APM is here to help with planning tips for buying a home in the new year.

Surprising Factors that Influence Mortgage Interest Rates

Interest rates are one of the biggest factors that can influence your homebuying process. This little—or big—number can dictate how much house you can afford . . . and if you can afford to buy a house at all. With so much riding on this figure, it’s important to understand what determines interest rates.

Now, we know what you’re thinking: I know what determines interest rates. My credit score and the size of my down payment! And you would be correct on that, to some degree. While credit score and down payment are two factors that may impact the exact mortgage interest rate offered to you, there are larger interest rate factors at play that determine where these published rates will land day in and day out.

Though you may not know it, there are five surprising factors that can influence mortgage interest rates.

Everything You Need To Know About Mortgage Loan Servicing

You’ve submitted all your financial documents, completed your paperwork and secured your new home loan or refinance. Pop some champagne and celebrate all that you have accomplished! Though this may feel like the end, it’s actually just a stop on your homeownership journey.

What Paying Off Your Mortgage Early May Mean For You

Is it smart to pay off your mortgage early? It certainly can be, in certain situations. In other scenarios, it may make more sense to put that money to work elsewhere, or to keep it in the bank.

Steps to Qualify For A Home Loan

The path to homeownership is right in front of you – you just need to take the first step of qualifying for a home loan! Luckily, our trusted loan advisors can help you with this. The steps to qualify for a home loan can be easily simplified once you have a reliable partner in your corner.

Demystifying Home Loan Closing Costs

As you make the decision to move forward on your homeownership journey, you may be wondering about all of the costs involved in purchasing a home. In addition to your down payment, you will also need to plan for closing costs.

What Documents Do You Need For A Home Loan?

Getting your ducks in a row when applying for a mortgage can seem daunting, but it doesn’t have to be! Lenders, underwriters and APM are here to help you determine what type of loan, including size, duration and other terms, are right for you.

How to Quickly Save More for a Down Payment

It’s not feasible for most people to snap their fingers and – poof! – a 20 percent down payment appears. For some, saving for a down payment can be a long-term process. While there are many down payment assistance programs and loan options that can make the down payment a little easier to swallow, there are also a few habits you can implement to quickly save for a down payment.

Boost Your Credit Score With 5 Simple Tips

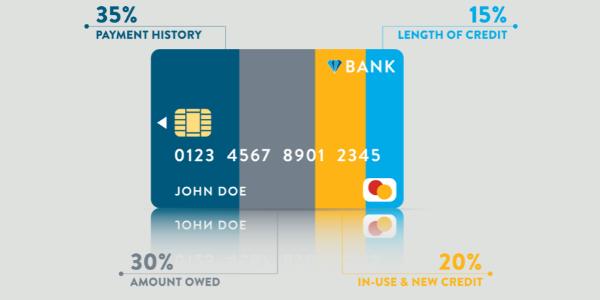

Have you been thinking about purchasing a home sometime this year? As you prepare for that exciting journey, you’ll want to check your credit score. Your credit score, often referred to as your FICO® score, is calculated using your credit history on file with the credit reporting agencies. No matter what your score is, you can work on boosting it by following a few simple tips.

Why You Should Start the Home Buying Process with a Pre-Approval

Buying a home can be exciting. You know you want to buy a house, but where should you begin? The ideal place to begin the home buying process is with getting a pre-approval for a home loan.

TOP POSTS

Subscribe to our BlogSign up to stay up to date with the latest news, insights and more from American Pacific Mortgage!

RECENT POSTS