November is National Veterans and Military Families Month and also celebrates Veteran's Day. One of ways we like to honor and celebrate our veterans is by sharing the stories of what home and homeownership means to them.

Kim DeMarco, Loan Advisor & Veteran, NMLS #410006

Branch: U.S. Marine Corps (Reserves)

Years of Service: 8 years (4 active reserve, 4 inactive reserve)

For Kim DeMarco, service runs deep. Her family’s military lineage dates back to the American Revolution, so joining the Marines felt like a natural calling. She served in motor transport with the 4th Bulk Fuel Unit as part of the Marine Corps Reserves, balancing her service with helping care for her ailing father. “The Marine Corps is built on leadership, integrity, and honor,” Kim said. “Those values weren’t new to me, but serving made them part of my DNA.”

After the Marines, Kim went on to serve her community in a different way, first as a police officer, then as a mortgage professional. “All of it connects,” she explained. “In the military, I served the citizens of the United States. In lending, I still do. I help people achieve one of the greatest American dreams: homeownership.”

Kim remains deeply involved in the veteran community through the Marine Corps League and the American Legion and dedicates much of her work to educating veterans about their VA loan benefits. “Being a Marine was the toughest thing I’ve ever done,” she said. “It’s also the thing I’m most proud of.”

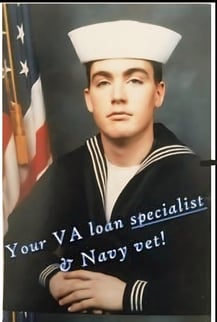

Chris Hodges, Branch Manager & Veteran, NMLS #1146098

Branch: U.S. Navy

Years of Service: 9½ years

For Chris Hodges, service has always been about purpose. He joined the Navy in 2000, driven by a desire to see the world and serve his country. Over the next nine and a half years, Chris completed multiple deployments to the Middle East, serving aboard the USS Harry S. Truman and later at a land base in Bahrain. But his most life-changing experiences came through humanitarian missions, including relief efforts after the devastating 2004 tsunami in Sri Lanka and vaccine distribution in remote Tunisian villages.

After being medically separated from service, Chris used his GI Bill to earn his degree and discovered a new calling in finance and real estate. “Nine out of ten clients I met who built real wealth did it through real estate,” he shared. His curiosity, and his wife Heather’s longtime career in lending, led him naturally into the mortgage industry, where his military mindset found a perfect fit.

Today, as an APM Loan Adviser in Colorado Springs, home to five major military installations, Chris continues to serve. His business focuses on educating and empowering service members to build long-term financial stability through homeownership. “The drive to find solutions, to figure out a way to make it work, that’s straight from my military training,” he said.

Quote:

“There’s always a way to make it work. That’s what the military taught me and that’s how I help my clients every day.”

Michael Quinn, Branch Manager & Veteran, NMLS #228210

Branch: U.S. Navy

Years of Service: 4 years

Michael Quinn’s time in the Navy shaped him into the leader he is today. As an operations specialist during the Desert Storm era, he was stationed in the Western Pacific tracking submarines and coordinating warfare operations from the Combat Information Center aboard a cruiser. “We were the eyes and ears of the ship,” he said. “It was surreal, but it taught me precision, focus, and discipline at a young age.”

After his service, Michael pursued college and a career in real estate before finding his true fit in lending. What began as a curiosity soon became a passion for helping families achieve homeownership. “I’m more of a consultant than a salesperson,” he said. “Helping clients build a life around their home is what fulfills me.”

The discipline and attention to detail learned in the military are at the heart of his work today. “Do the small things masterfully,” Michael said. “That’s how you win in life, in business, and in serving your clients.”

Nigel Farnsworth, Loan Advisor & Veteran, NMLS #270178

Branch: U.S. Marine Corps

Years of Service: 8 years (4 active, 4 inactive)

When Nigel Farnsworth joined the Marine Corps, he wasn’t just signing up for military service; he was signing up for a lifelong transformation. Based in California at Camp Pendleton, Nigel worked in the munitions field and later as a military policeman. “The Marine Corps taught me honor, courage, and commitment,” he said. “Those core values shaped the person I am today.”

The teamwork and resilience that defined his service continue to guide his approach in the mortgage industry. “In the Marines, you never give up,” Nigel explained. “That same mindset applies when you’re serving clients. No matter what happens, you stay committed to seeing it through.”

Today Nigel carries those values forward both professionally and personally. He mentors veterans through the VA Court in Salt Lake City and stays active in the community, helping others find stability and growth. “The military changes you from the inside out,” he said. “Those lessons become part of who you are.”

Jory Ryland, Learning & Development Associate

There are a few things that the military and the mortgage industry have in common that Jory appreciates. One is the camaraderie. After eight years in the Army as a combat medic—which included three stints in Iraq—Jory was searching for meaning in her next career move. She was also missing the camaraderie she’d formed in the military.

There are a few things that the military and the mortgage industry have in common that Jory appreciates. One is the camaraderie. After eight years in the Army as a combat medic—which included three stints in Iraq—Jory was searching for meaning in her next career move. She was also missing the camaraderie she’d formed in the military.

After joining APM in 2015, Jory feels like she’s found those special relationships once again. Having worked under great leaders and on amazing teams, Jory has brought many experiences and lessons from the Army to APM, where she serves as a learning and development associate.

The Army taught her to stay mission-ready. That practice makes perfect. That a team member’s roadblock is her roadblock. And that muscle memory will always allow you to remain calm under pressure because you’ll automatically remember what to do.

These lessons were also instilled in her from a young age by her father, mortgage industry veteran Dave Ryland. Jory grew up doing homework in the conference room and lunchrooms of her dad’s mortgage office. Dave even served as a mentor for Kurt Reisig, APM’s chairman. In a very large way, you could say Jory’s inherent love for good leaders and strong teams originally came from her father, before these values were honed in the Army and then brought full circle to APM.

These days, Jory remains committed to helping the loan officers who help veterans. She encourages her loan officers to be the point of contact for veteran and military groups, ensuring that their community members are well-educated on VA loans and their benefits. Jory is a firm believer in communicating early and often. She does this with her loan officers, and she loves to see her LOs pass on that enthusiasm to their veteran clients.

Michael Farmer, Loan Advisor & Veteran, NMLS #2161015

Michael loved serving his country during his 20-year career in the Navy. In fact, he credits much of his success today as a loan officer to his many experiences during his time of service. Working in Supply/Logistics allowed him to help his branch and country prepare for whatever challenges were ahead. The atmosphere was always changing, the duties were varied, and the camaraderie was unparalleled.

After Michael retired from the Navy in 2017, he looked for a career that would provide a similar level of fulfillment, as many veterans do. He appreciated all the skills the military had afforded him, including the ability to build teams, network, and communicate effectively. Mike found that passion again working as a loan officer for APM in Kennewick, Washington, where he lives with his wife and four children.

As a veteran of the military, Michael is also a veteran user of the VA home loan benefit. He understands the importance and value this program can bring to current and past service members. He also understands that there is a gap in education and many misconceptions when it comes to VA home loans among the military community. As such, he makes it his mission to ensure that his local active-duty and veteran community are well-versed in the benefits of their VA entitlement.

Michael also understands the transition that service members must endure when their military career ends—and he wants to be sure they know that a fellow veteran is in their corner when that transition happens. Michael is a member of the Columbia Basin Veterans Center and volunteers as a veteran court mentor to help his service brothers and sisters who find themselves in the court system and in need of support.

Michael considers it his duty and honor to continue serving his country by assisting those who have served us.