Protecting your credit score is important all the time, but even more so when you’re thinking about buying a home and need a mortgage loan. That’s because there aren’t many other times in our lives when we need a loan amount of this size.

Our Blog Puts YOU in the Driver’s Seat

Helping customers like you achieve their financial goals is all we do, which is why we’re arming you with our expert insight, tips, and advice to help you get there.

Protect Your Credit Score During the Home-Buying Process

8 Ways to Pay Off Debt

It’s no fun to have a lot of debt hanging over your head. It’s even less fun when that balance is large enough to keep you from doing the things you want to do and achieving the dreams you’ve always had.

The Most Common First Time Homebuyer Mistakes

You did it—you saved for a down payment and closing costs, worked on your credit score, determined how much house you can afford, got pre-approved, and became a first time homebuyer. We’re exhausted just listing all you’ve accomplished! You should be proud of yourself—very proud of yourself.

How to Get a Home Loan with No Credit

It’s true that credit can be an important part of qualifying for a home loan, but it’s not the end-all and be-all. There are buyers who get a home loan with little or no credit—the process just takes a few extra steps.

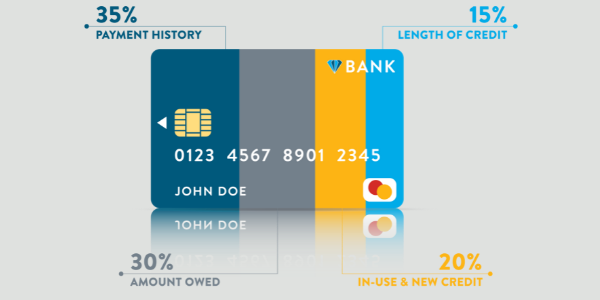

How Your Credit Score Is Calculated

You know credit scores are important, but you may be wondering how they are calculated and what the big deal is. This all-important number can be looked at for a multitude of reasons: when you get a job, lease an apartment, open a new account, or apply for a loan—including a home loan.

Tips to Improve Your Credit Score

Your credit score is an important factor when it comes to buying a home. That’s because it gives your lender a snapshot of how responsible you’ve been as a borrower through your payment history—which means they can assess how responsible you’re likely to be as a borrower going forward.

What Credit Score is Needed to Buy a House

One of the most important factors which determines your home loan qualifications and rate is your credit score. If you are at the beginning of the home buying process, it’s important to understand how your credit score can impact your ability to get a mortgage loan, as well as the interest rates you may be offered. Understanding your credit is one of the first steps you will take to becoming a home buyer, so let’s get started.

Top 5 Questions to Understanding Your Credit Score

1. What is a Credit Score?

A credit score is a three-digit number used to determine the creditworthiness of an individual and is created by the Fair Isaac Corporation (FICO). The score is calculated based on an analysis of a person's credit history and files.

Credit Score: Here's What You Should Know When Buying a Home

If you are thinking about buying a home, it’s a good idea to know your credit score and understand how that score will affect your interest rate and payments. You can take the right steps now to improve your credit score, so you have more options when the time comes.

How Can I Get My Credit Score?

Knowing what your credit score is can be empowering to you as a first-time homebuyer. Your credit score is an important factor in getting a loan and securing a competitive interest rate when buying a home.

What is a Good Credit Score?

Your credit score is a number between 350 - 850 on a scale created by the Fair Isaac Corporation (FICO). This number is known as your FICO® score, and it is used by lenders as a snapshot of your credit history and a summary of risk involved to lending to you. The score is calculated based on an analysis of a person's credit history and files.

The higher the credit score, the lower the risk to the lender and generally means a lower interest rate to you as a borrower. A lower credit score equates to more potential risk to lenders and generally higher interest rates to you as a borrower.

The Ins and Outs of a Credit Score

A credit score is more than just a financial “grade.” The rating represents something much more important, and could have a big impact on your wallet. Many first-time homebuyers are curious about improving credit scores, and how that will come into play when applying for a loan.

4 Tips to Help Improve Your Credit Score Long-term

If you are ready to become a first-time home buyer, the initial step is to get pre-approved for a home loan. To do that, you will need to get a handle on your credit history and credit score. If your credit is challenged, you may want to consider methods of increasing your score so that you can begin the process of buying your first home.

TOP POSTS

Subscribe to our BlogSign up to stay up to date with the latest news, insights and more from American Pacific Mortgage!

RECENT POSTS