You know credit scores are important, but you may be wondering how they are calculated and what the big deal is. This all-important number can be looked at for a multitude of reasons: when you get a job, lease an apartment, open a new account, or apply for a loan—including a home loan.

Understanding credit scores, credit utilization ratios, scoring calculations, payment history, length of credit history, and credit scoring models will arm you with the information you need to review—and even improve—your credit score. And it’ll come in handy when you’re ready to purchase or refinance a home.

How a Credit Score Is Calculated

The most common credit score used is called your FICO score, which stands for Fair Isaac Corporation, a data company that tracks and measures credit risk. The score is calculated using information contained in your credit reports with each of the three main reporting agencies, then compiled and weighted to get your score, which in turn can affect how much a lender will loan you and at what interest rate.

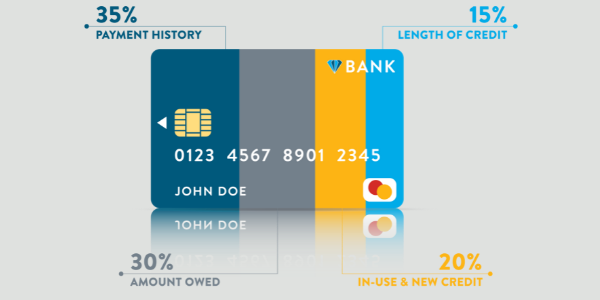

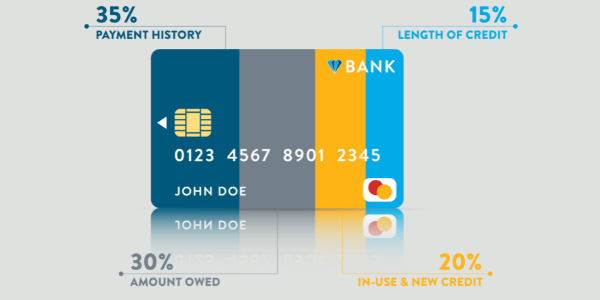

While the exact formula is unknown, we do know that FICO scores are calculated by considering five distinct categories. The importance of each varies, as well as the factors within every category.

Payment History (Weight: 35%)

Have you paid past credit accounts—including installment loans like auto loans, medical bills, and student loans—on time? How many accounts have late or missed payments?

Amounts Owed (Weight: 30%)

How much do you owe on your credit accounts, and how many accounts do you have? How much of your total available credit—also known as your credit utilization ratio—are you using?

Length of Credit History (Weight: 15%)

The longevity of your credit history is important. How long have your credit accounts been established? What is the average age of these accounts, and how long has it been since you last used some of those accounts?

Credit Mix in Use (Weight: 10%)

What types of credit accounts do you have? How many different types of credit accounts are you using?

New Credit (Weight: 10%)

How many new accounts or recent inquiries do you have on your credit report? How long has it been since you opened new credit accounts or credit limits?

Credit Score Ranges

Credit scores range from 300 to 850. These scores can be subjective, and all lenders are different, but in general, these credit scores translate to:

- 800 or higher: Exceptional

- 740–799: Very good

- 670–739: Good

- 580–669: Fair

- 579 or lower: Poor

Even if your credit score is not in the good or higher range, there are still plenty of loan programs that may be available to you.

Talk to APM about what loan programs your score qualifies you for—and what other options may work for your situation. Naturally, you should also aim to improve your credit score or, at the very least, make sure your behavior doesn’t hurt your credit score further.

Improve Your Credit Score

Once you understand the scoring calculations and credit scoring models, there are things you can do to improve your credit score:

- Make on-time payments. Set reminders or have payments made automatically to ensure that you pay your bills on time.

- Create some balance in how you reduce your debt. While paying down installment loans (auto loans, school, mortgage, and so on) will definitely improve your credit score, paying your bills down or off can cause a quick jump in your credit score. The trick is to get and keep your balances below the credit utilization ratio of 30%. That means you should use only 30% of the credit limit available on each card. For faster results, pay your bills with the highest credit utilization ratio first, as opposed to the cards with the highest debt.

- Check for errors and inaccuracies. Get a free copy of your credit report, review it carefully, and contact the bureau if you find any errors.

Don’t Hurt Your Credit Score

If you want to improve your credit score, you have to first make sure you’re not engaging in behaviors that hurt it. These negative impacts could be a problem when it comes time to buy a home. With that in mind, you want to:

- Avoid opening too many new accounts in a short amount of time. Let accounts have some aging time; that way you can establish a consistent payment history.

- Avoid moving debt around to multiple cards. Focus instead on reducing the amount by making on-time payments.

- Keep your accounts open. Do NOT close your credit accounts. A sudden drop to your credit spending power does not look good to the bureaus. Keep your accounts active by using them to pay your bills, including your auto loans, installment loans, and other types of debt … without accruing any frivolous new debt in the process.

Additional Resources

APM has you covered when it comes to understanding your credit and navigating the home loan process. Check out the following for further information:

- What Is a Good Credit Score to Buy a House?

- 5 Tips to Improve Your Credit Score

- Understanding Credit Guide

Now you’re ready to hit the ground running as you improve your credit score. Here’s the thing, though: You don’t have to wait until your credit score is exceptional to purchase a home.

APM’s trusted Loan Advisors can work with you now to find a loan program that fits your needs—and we continue working with you as your score and situation change.